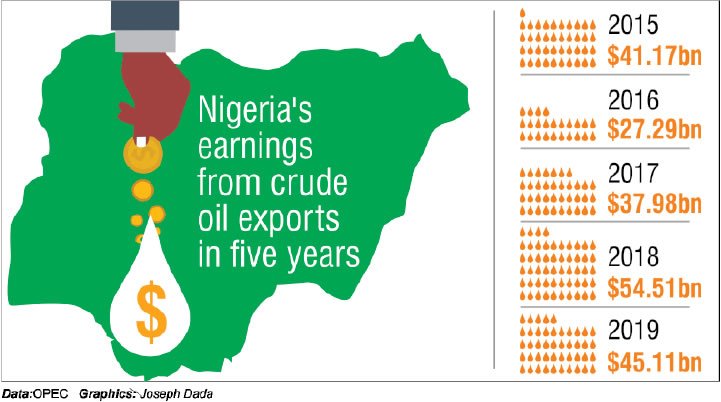

Nigeria, Africa’s top oil producer, generated $206.06bn in revenue from crude oil exports in the last five years, the Organisation of Petroleum Exporting Countries has said.

OPEC, in its 2020 Annual Statistical Bulletin released on Monday, said the country’s oil export revenue fell to $45.11bn in 2019 from $54.51bn in 2018.

Nigeria was the fifth biggest revenue-earner last year in OPEC after Saudi Arabia ($202.37bn), Iraq ($80.03bn), Kuwait ($52.43bn) and the United Arab Emirates ($49.64bn).

The country earned $37.98bn from oil exports in 2017, compared to $27.29bn in 2016 and $41.17bn in 2015.

Exports of Nigeria’s crude oil to Europe plunged to 680,600 barrels per day in 2019 from 1.06 million bpd in 2018, according to the report.

The total volume of oil exported to North America slumped by 84 per cent to 27,500 bpd in 2019 while exports to Africa fell by 15.77 per cent to 260,700bpd.

The country’s exports to Asia and the Pacific rose by 71.72 per cent to 664,900 bpd in 2019, while exports to the Middle East jumped from zero to 122,300bpd.

OPEC’s 13 members suffered an 18.4 per cent contraction in their oil export revenue in 2019 on slumping prices, the report showed.

The price of Brent crude, the international oil benchmark, averaged $64 per barrel in 2019, down from $71 per barrel in 2018, according to the US Energy Information Agency.

The value of OPEC petroleum export revenue fell to $564.9bn in 2019 from $692.3bn in 2018 as weak demand growth and continued competition from non-OPEC producers impacted the group.

The figures demonstrate the financial pain OPEC was already facing even before the coronavirus pandemic wiped out nearly a fifth of global oil demand in the second quarter of 2020, according to S&P Global Platts.

The producer group has continued efforts to prop up the market through production cuts, as the oil-dependent governments try to defend prices over market share.

OPEC cut its production by 1.86 million bpd, or six per cent, last year, while non-OPEC output grew by 1.3 million bpd, or 2.9 per cent, the report showed.The group is in the fourth year of coordinated production cuts with 10 allies, including Russia.

The deal for 2019 called for 1.2 million bpd in combined cuts between the 23 countries, though core Gulf OPEC members Saudi Arabia, the UAE and Kuwait contributed voluntary additional cuts to help boost the market’s recovery.

(Punch)

Leave a Reply